David H. Klein | Mr.

President, Klein 70, has been aSolutions Group Age: 73 Independent Director since September 2012. He is the 2012 | Experience •President of Klein Solutions Group, LLC, which provides advice on policy, strategy, operations and finance to healthcare delivery and payer organizations. Mr. Klein also serves as: a specialorganizations (2012 – present) •Special advisor to the CEO, of the University of Rochester (UR) Medical Center a professor(2012 – present) •Professor of public health sciences in thePublic Health Sciences, UR School of Medicine and Dentistry and as an executive professorExecutive Professor of healthcare management in theHealthcare Management, UR Simon Business School. Mr. Klein was most recently the School (2012 – present) •Chief Executive Officer, of The Lifetime Healthcare Companies, which was comprised of Excellus BlueCross BlueShield (BCBS), Univera Healthcare, Lifetime Health Medical Group, Lifetime Care (home care agency),EBS-RMSCO Benefit Solutions (benefits consulting firm and third party administration) and MedAmerica (long-term care insurance company). Mr. Klein had been a senior executive with The Lifetime Healthcare Companies (2003 – 2012) •Director of the national BlueCross BlueShield Association (BCBSA) and its predecessor companies since 1986, serving as CEO from 2003 until 2012. Mr. Klein previously was an executiveAmerica’s Health Insurance Plans (2003 – 2012) •Executive with the national BlueCross BlueShield Association and Health Care Service Corporation. He served as DirectorCorporation (1984 – 1986) Education •MBA, University of the national Blue Cross Blue Shield Association (BCBSA) and America’s Health Insurance Plans. Mr. Klein currently serves as a Director of the following privatelyChicago – 1972 •BS, Rensselaer Polytechnic Institute – 1970 Other Boards •Privately held companies: Landmark Health (a General Atlantic and Francisco Partners (private equity fund) company which |

2

| creates and manages home visiting multi-disciplinary medical groups to care for complex, chronically ill patients)(2014-2021), Avalon Healthcare Solutions (also a Francisco Partners private equity fund) company that provides laboratory benefits management solutions, Cogito (a Goldman Sachs/Open View Partner/Romulus Capital funded customer engagement/voice analytics company)(2016 – present), NextHealth Technologies (a Norwest(2017 – 2022), Excel Venture Partners patient engagement optimization company)Fund (2017 – present), PNT (a claims and clinical information data acquisition company), Excel Partners Venture Fund (a venture capital fund that invests in high-tech startups focused on Upstate New York), Transparent Health Marketplace (a provider network management company using spot pricing and patient navigation to create value), CompanionMx (a behavioral health telemonitoring company) and Orthometrics (a technology enabled musculoskeletal injury risk management company). Mr. Klein is a member of theOpyn (2019 – present); Honest Medical Group (2022 – present)

•Member, Cressey & Company private equity fund Distinguished Executives Council. He serves as an advisor toCouncil (2016 – present) •Advisor, Health Catalyst Capital Management, LLC private equity fund, asand Triple Tree Capital Partners venture funds (2019 – present) •Former non-executive chair of the(2016 – 2020), New York eHealth Collaborative which operates New York State’s health information exchange and as a (2014 – 2021) •Director of Commonwealth Care Alliance (a health plan that serves high cost high needhigh-cost, high-need patients). (2019 – present) Qualifications With regard to Mr. Klein, is a member of Johns Hopkins University Carey School of Business Health Care Advisorythe Nominating and Corporate Governance Committee and the Board particularly noted his extensive experience managing health plan entities and has chaired United Way of Greater Rochester and an American Cancer Society Capital Campaign to establish a new Rochester Hope Lodge. He has also been presidenthis knowledge of the local Boy Scout Council and Director of Northeast Region, Boy Scouts of America. He is a Boy Scouts’ Distinguished Eagle Scout and a recipient of their Silver Beaver and Silver Antelope awards. Mr. Klein received a Bachelor of Science from Rensselaer Polytechnic Institute and his Master of Business Administration fromhealthcare industry, an important market for the University of Chicago.Company’s services. |

| |

Valerie Rahmani Age: 64 Independent Director since 2015 | Ms. Rahmani, 61, was appointed to CTG’s Board of Directors in November 2015. Ms. Rahmani is anon-executive Director and member of the Risk Committee of the London Stock Exchange Group plc. She is anon-executive Director and member of the Audit Committee of RenaissanceRe Holdings Ltd, a Bermuda-based reinsurance company. She is anon-executive Director and member of the Compensation Committee of Entrust Datacard, a Minneapolis based company. She is also a Board member of a social media startup, Rungway, based in London, and is the part-time CEO of the Innovation Panel of Standard Life Aberdeen plc, a global investment company based in the UK. From 2010 to 2015, Ms. Rahmani was a member of the Board of Directors of Teradici Corporation—a private technology company where she served on the Audit and Compensation Committees. She most recently served as Experience

•Chief Executive Officer of Damballa, Inc. from 2009 to 2012. Damballa was a venture capital funded cyber-security company headquartered in Atlanta, Georgia. Prior to her role at Damballa, Ms. Rahmani was with IBM in various managerial capacities for 28 years. Her latest role with IBM was(2009 – 2012) •IBM: General Manager of IBM Internet Security Systems. Other IBM roles includedSystems (2008 – 2009), General Manager of the $2.7 billion Global Technology Services business head(2004 – 2008), Head of Sales and |

3

| Services Strategy unit (2003 – 2005), General Manager of IBM’s $3.5 billion UNIX server business (2001 – 2003), General Manager of IBM’s Mobile business as well as serving as the Executive Assistant(2000 – 2001); joined 1984 Education •DPhil, University of Oxford •MA, University of Oxford Other Boards •Elliott Opportunity II Corp. (2021 – present) •Entrust Corporation (2019 – present) •London Stock Exchange Group plc (2017 – present) •RenaissanceRe Holdings Ltd (2017 – present) •Teradici Corporation, a private technology company (2010 – 2015) Qualifications With regard to Louis Gerstner, former Chairman and Chief Executive Officer of IBM. Ms. Rahmani, holds an MAthe Nominating and a Doctor of Philosophy degreeCorporate Governance Committee and the Board particularly noted her experience in Chemistry from Oxford University, England.technology and cyber-security and her extensive management experience within the IT Services industry. |

Nominee for Class III Director Whose Terms Expire in 2019

Filip J.L. Gydé

| Mr. Gydé, 59, was named Chief Executive Officer of the Company and appointed to the Company’s Board of Directors effective March 1, 2019. Mr. Gydé has been with CTG since October 1990 and most recently served as the Executive Vice President, General Manager, and President for CTG’s European operations. Mr. Gydé led the Company’s European operations from October 2000 through February 2019, and served as Interim Executive Vice President of Operations of CTG from October 2014 to April 2015, during which time he was responsible for overall company operating activities. |

Class II Directors Whose Terms Expire in 2020at the 2023 Annual Meeting | | | |

James R. Helvey, III | Mr. Helvey, 60, was appointed to CTG’s Board of Directors in November 2015. Mr. Helveyco-foundedManaging Partner, Cassia Capital Partners, LLC a registered investment advisor, in 2011 Age: 63 Independent Director since 2015 Chair of the Board since 2021 | Experience •Co-founder and has served as a managing partner since its formation. From 2005 to 2011, Mr. Helvey was a partnerManaging Partner, Cassia Capital Partners, LLC, (2011 – present) •Partner and the Risk Management Officer, for CMT Asset Management Limited, a private investment firm. From 2003 to 2004, Mr. Helvey was a candidatefirm (2005 – 2011) •Candidate for the United States Congress in the 5th District of North Carolina. Mr. Helvey served as ChairmanCarolina (2003 – 2004) •Chair and Chief Executive Officer, of Cygnifi Derivatives Services, LLC, an online derivatives services provider from 2000 to 2002. From 1985 to 2000, Mr. Helvey was employed by J.P.(2000 – 2002) •Managing Director at JP Morgan & Co., serving in a varietyincluding Vice Chair of capacities, including as Vice Chairman of J.P. Morgan’sthe Risk Management Committee, Chair of J.P. Morgan’sthe Liquidity Committee, Global Head of Derivative Counterparty Risk Management, headHead of the swap derivative trading business in Asia, and head of short-term interest rate derivatives and foreign exchange forward trading in Europe. Mr. Helvey graduated magna cum laude with honors from Wake Forest University. Mr. Helvey was also a Fulbright Scholar at the University of Cologne in Germany and received a Master’s degree in international finance and banking fromEurope, (1985 – 2000) Education •MA, Columbia University, School of International and Public Affairs, where he was an International Fellow. Mr. Helvey is a director and serves on the Audit CommitteeFellow •Fulbright Scholar, University of Cologne in Germany •BA, magna cum laude, Wake Forest University Other Boards •Coca-Cola Bottling Co. Consolidated., a publicly traded and independent bottler of Coca-Cola Company products, Consolidated (2016 – present) •Trustee Wake Forest University (1997 – 2017) •Pike Corporation, Lead Independent Director (2005 – 2014) •Verger Capital Management LLC •Piedmont Federal Savings Bank (Audit Chair), and has also served on the board of trustees of Wake Forest University and the •Wake Forest Baptist Medical Center.Center & Health Sciences Qualifications With regard to Mr. Helvey, was a director of Pike Corporation, an energy solutions provider, from 2005 to 2014, where he served as Lead the Nominating and Corporate Governance Committee and the Board particularly noted his extensive financial experience and prior audit committee experience. |

| |

Kathryn A. Stein Chief Strategy Officer and Global Business Leader, Enterprise Services and Analytics, Genpact Limited Age: 45 Independent Director Chairman ofsince 2021 | Experience •Chief Strategy Officer and Global Business Leader, Enterprise Services and Analytics, Genpact Limited, a Business and IT services provider (2016 – present) •Partner, Market Business Leader – Retirement for the Audit Committee and Chairman of the Compensation Committee. |

4

Owen J. Sullivan

| Mr. Sullivan, 61, was appointed to the Board of Directors in February 2017. Mr. Sullivan isEast Market, Mercer (2015 – 2016) Partner, Global Chief Operating Officer, Retirement, Health and Benefits (2014 – 2015) Partner, Director of NCR, a position he has heldNorth America Region Strategy and Operation (2012 – 2014); Principal, Global Strategy and Corporate Development (2010 – 2012)•Project Leader, Boston Consulting Group (2003 – 2005) •Assistant Director, Strategic Planning, Center for Strategic and International Studies (2003 – 2005) •Consultant, MarketBridge Consulting (1999 – 2003) Education •MBA, Columbia Business School •BA, University of North Carolina at Chapel Hill Qualifications With regard to Ms. Stein, the Nominating and Corporate Governance Committee and the Board particularly noted her extensive experience in IT digital transformation services and mergers and acquisitions. |

Class III Directors Whose Terms Expire at the 2024 Annual Meeting | | | |

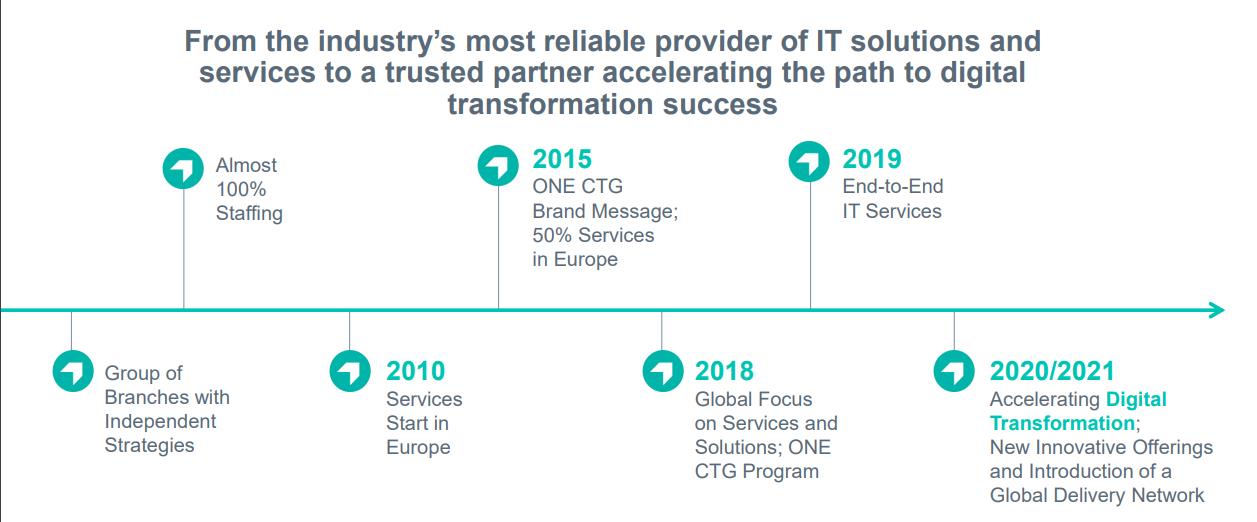

Filip J.L. Gydé President & Chief Executive Officer, Computer Task Group Age: 62 Director since July 2018. Before becoming 2019 | Experience •Chief OperatingExecutive Officer, Computer Task Group, Incorporated (2019 – present); Executive Vice President, General Manager and President for CTG’s European operations (2018 – 2019); Senior Vice President and General Manager of NCR, Mr. Sullivan was an independent consultant, providing strategic planning, consulting and executive mentoring, and working with and investing alongside private equity firms and other investor groups. Prior to that, Mr. Sullivan was with ManpowerGroup, a workforce and talent management solutions company, from 2003 to 2013. At ManpowerGroup, he served asCTG’s European operations (2000 – 2014, 2015 – 2018), Interim Executive Vice President of operations, assisting the Specialty BrandsInterim CEO in overseeing CTG’s worldwide operations (2014 – 2015); Managing Director for Luxembourg (1999 – 2000); Managing Director for Belgium (1996 – 2014), joined 1987 Education •MBA, University of Antwerp •MS, Ghent University Qualifications With regard to Mr. Gydé, the Nominating and Experis units from 2010Corporate Governance Committee and the Board believe that it is important that they have immediate access to 2013, and he servedhis direct involvement in the management of the Company as the Chief Executive Officer, as he brings more than 30 years of experience in the Right ManagementIT services industry to his positions. |

Raj Rajgopal President, RR Advisory Services Age: 62 Independent Director since 2020 | Experience •President, RR Advisory Services, LLC, an advisory firm that offers due diligence and Jefferson Wells International, Inc. subsidiaries from 2004consulting services to 2013venture capital, private equity, and from 2003 to 2010, respectively. Before joining ManpowerGroup, Mr. Sullivan was with Sullivan Advisors, LLC,large enterprises (2019 – present) •Independent Director of Vuzix Corporation (2021 – present), a provider of strategic planning,augmented reality/virtual reality smart glasses to enable enterprise digital transformation •President, Virtusa Corporation (2013 – 2019); successfully led Virtusa’s transformation from an engineering services firm to a leading digital consulting, digital solutions and executive mentoring for smallIT services organization; Independent consultant tomedium-sized businesses from 2001-2003. Prior Virtusa Corporation (2003 – 2005), helped set the company’s long-term growth strategy •Global leadership roles in both the U.S. and the U.K., Capgemini, a global leader in consulting, technology services and digital transformation (1991 – 2003) •Director of Advanced Technologies, BGS Systems, Inc. (1985 – 1989) Education •MBA, Massachusetts Institute of Technology •MS, Virginia Tech •BTech, Indian Institute of Technology, Madras Qualifications With regard to that, Mr. Sullivan was with Metavante Technologies, Inc., a bank technology processing company from 1993 to 2001, where he served in various management roles including asRajgopal, the President of Metavante’s Financial Services GroupNominating and Enterprise Solutions Group. Mr. Sullivan is a member ofCorporate Governance Committee and the Board of Directors of Johnson Financial Groupparticularly noted his extensive experience in IT digital transformation services and serves as a member of its Wealth Management, Risk and Succession Committees. In addition, Mr. Sullivan is a member of the Board of Directors at Marquette University and serves as Chairman of the Board and a member of its Executive and Nominating and Governance Committees.global business background. |

Class III Director Whose Terms Expire in 2021

Board Skills Summary Daniel J. SullivanKey Qualifications & Areas of Expertise

| Mr. Sullivan, 73, has been a DirectorGydé | | Mr. Helvey | | Mr. Klein | | Ms. Rahmani | | Mr. Rajgopal | | Ms. Stein | Board / Senior Leadership | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Finance / Audit | | | ✓ | | ✓ | | ✓ | | | | | IT Digital Solutions / Services | ✓ | | | | | | ✓ | | ✓ | | ✓ | Global / International | ✓ | | ✓ | | | | ✓ | | ✓ | | ✓ | Human Capital | ✓ | | | | ✓ | | ✓ | | ✓ | | ✓ | M&A / Business Development | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | Public Company Board | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | ✓ | | | | | | | | | | | | | Board Diversity Matrix - Demographic Background (as of CTG since 2002 and was appointed to serve as thenon-executive Chairman of the Board of Directors in October 2014. He most recently served as the President and Chief Executive Officer of FedEx Ground from 1998 until 2007. FedEx Ground is a wholly owned subsidiary of FedEx Corporation. From 1996 to 1998, Mr. Sullivan was the Chairman, President and Chief Executive Officer of Caliber System. In 1995, Mr. Sullivan was the Chairman, President and Chief Executive Officer of Roadway Services. Mr. Sullivan is currently a member of the Board of Directors of Schneider National, Inc. (Green Bay, Wisconsin), where he serves asnon-executive Chairman of the Board of Directors. Mr. Sullivan is also an Emeritus Director of the Board of Directors of The Medical University ofAugust 5, 2022) | | | | | | | | | | | | Gender Expression | Male | | Male | | Male | | Female | | Male | | Female | Asian (other than South Carolina Foundation where he serves as Vice Chairman of the Board of Directors. Mr. Sullivan previously served as a member of the Board of Directors of Pike Electric, Inc. from 2007 to 2014 (Pike Electric was sold in December 2014 to Court Square Capital Partners), GDS Express (Akron, Ohio) from 2004 to 2009; and Gevity, Inc. (Bradenton, Florida) from 2008 to 2009. He is a former federal commissioner for the Flight 93 National Memorial project in Somerset County, Pennsylvania.Asian) | | | | | | | | | ✓ | | | White | ✓ | | ✓ | | ✓ | | ✓ | | | | ✓ |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE THE TWO NOMINEES FOR CLASS I AND CLASS III DIRECTORS HOW WE ARE SELECTED 5

SECURITY OWNERSHIP OF THE COMPANY’S COMMON SHARES

BY CERTAIN BENEFICIAL OWNERS AND BY MANAGEMENT

Security Ownership of Certain Beneficial Owners

As of June 7, 2019, the following persons were beneficial owners of more than 5% of the Company’s common stock. The beneficial ownership information presented is based upon information furnished by each person or contained in filings made with the SecuritiesBoard Composition and Exchange Commission. The Company is not aware of any arrangements, including any pledge by any person of securities of the Company, the operation of which may at a subsequent date result in a change in control of the Company. Except as otherwise indicated, each holder has sole voting and investment power with respect to the shares indicated. The following table shows the nature and amount of their beneficial ownership.

| | | | | | | | | | | Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature

of Ownership | | | Percent

of Class | | Common Stock | | Neil S. Subin | | | 1,331,761 | (1) | | | 9.3 | % | | | 3300 South Dixie Highway, Suite1-365 | | | | | | | | | | | West Palm Beach, FL 33405 | | | | | | | | | | | | | Common Stock | | Minerva Advisors LLC, and related parties | | | 1,233,160 | (2) | | | 8.6 | % | | | 50 Monument Road, Suite 201 | | | | | | | | | | | Bala Cynwyd, PA 19004 | | | | | | | | | | | | | Common Stock | | Dimensional Fund Advisors LP | | | 986,590 | (3) | | | 6.9 | % | | | Building One | | | | | | | | | | | 6300 Bee Cave Road | | | | | | | | | | | Austin, TX 78746 | | | | | | | | | | | | | Common Stock | | Renaissance Technologies LLC, and | | | 939,700 | (4) | | | 6.6 | % | | | related parties | | | | | | | | | | | 800 Third Avenue | | | | | | | | | | | New York, NY 10022 | | | | | | | | |

(1) | Based solely on information contained in a Schedule 13G filed January 23, 2018, indicating that Neil S. Subin has sole voting and dispositive power over 1,297,033 shares; and shared voting and dispositive power over 34,728 shares.

|

(2) | Based solely on information contained in a Schedule 13G filed on January 31, 2019, indicating that Minerva Advisors LLC, Minerva Group, LP, Minerva GP, LP, Minerva GP, Inc. and David P. Cohen have sole voting power and sole dispositive power over 861,799 shares; and that Minerva Advisors LLC and David P. Cohen have shared voting power and share dispositive power over 371,361 shares.

|

(3) | Based solely on information contained in a Schedule 13G filed February 8, 2019, indicating that Dimensional Fund Advisors LP has sole voting and dispositive power over 931,488 shares and sole dispositive power over 986,590 shares.

|

(4) | Based solely on information contained in a Schedule 13G filed February 12, 2019, indicating that Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation beneficially own 939,700 shares, have sole voting power over 760,400 shares, sole dispositive power over 867,162 shares, and shared dispositive power over 72,538 shares.

|

6

Security Ownership by Management

The table below sets forth, as of June 7, 2019, the beneficial ownership of the Company’s common stock by (i) each director and nominee for director individually, (ii) each executive officer named in the summary compensation table individually, and (iii) all directors and executive officers of the Company as a group.

| | | | | | | | | | | | | | | | | Name of Individual or Number in Group | | Shares

Owned | | | Shares

Beneficially

Owned (1) | | | Total

Ownership (2) | | | Percent

of Class | | Arthur W. Crumlish (3) | | | 311,142 | | | | 178,067 | | | | 489,209 | | | | 3.4 | % | James R. Helvey III | | | 98,427 | | | | — | | | | 98,427 | | | | 0.7 | % | David H. Klein | | | 111,060 | | | | 33,096 | | | | 144,156 | | | | 1.0 | % | Valerie Rahmani | | | 96,543 | | | | — | | | | 96,543 | | | | 0.7 | % | Daniel J. Sullivan | | | 268,257 | | | | 200,000 | | | | 468,257 | | | | 3.3 | % | Owen J. Sullivan | | | 73,876 | | | | — | | | | 73,876 | | | | 0.5 | % | Filip J.L. Gydé | | | 152,943 | | | | 69,750 | | | | 222,693 | | | | 1.6 | % | Jeffrey D. Gerkin (4) | | | 7,558 | | | | 7,867 | | | | 15,425 | | | | 0.1 | % | John M. Laubacker | | | 106,589 | | | | 52,525 | | | | 159,114 | | | | 1.1 | % | Peter P. Radetich | | | 128,025 | | | | 77,875 | | | | 205,900 | | | | 1.4 | % | | | | | | | | | | | | | | | | | | All directors and executive officers as a group (10 persons) | | | 1,354,420 | | | | 619,180 | | | | 1,973,600 | | | | 13.9 | % |

(1) | Amounts represent number of shares available to purchase through the exercise of options that were exercisable on or within 60 days after June 7, 2019.

|

(2) | The beneficial ownership information presented is based upon information furnished by each person or contained in filings made with the Securities and Exchange Commission. Except as otherwise indicated, each holder has sole voting and investment power with respect to the shares indicated.

|

(3) | Mr. Crumlish retired as Chief Executive Officer and President of the Company and resigned as a director on March 1, 2019.

|

(4) | Mr. Gerkin resigned from the Company on March 8, 2019.

|

7

THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors is divided into 3 classes serving staggered 3 year terms. The Board has 6 directors and the following committees: (i) Audit, (ii) Compensation, and (iii) Nominating and Corporate Governance. During 2018, the Board and the Committees held a combined total of 24 meetings. Each director attended at least 75% of the total number of Board and committee meetings. The Company encourages its Directors to attend its annual meetings but has not adopted a formal policy requiring attendance. All Directors were in attendance either in person or by telephone at the 2018 annual meeting of shareholders.

Director Independence and Executive Sessions

The Board of Directors affirmatively determined in February 2019 that each of the Company’s fiveDiversity.non-management directors, which include James R. Helvey III, David H. Klein, Valerie Rahmani, Daniel J. Sullivan, and Owen J. Sullivan, is an independent director in accordance with our corporate governance policies and the standards of the NASDAQ Stock Market (“NASDAQ”). Messrs. Daniel J. Sullivan and Owen J. Sullivan are not related. As a result of these five directors being independent, a majority of our Company’s Board of Directors is currently independent as so defined. The Board of Directors has determined that there are no relationships between the Company and the directors classified as independent other than service on our Company’s Board of Directors.

The foregoing independence determination also included the conclusions of the Board of Directors that:

each member of the Audit Committee, Our Board’s Nominating and Corporate Governance (“NCG”) Committee periodically evaluates the size and Compensationcomposition of our Board relative to our current and future needs, ongoing strategy and our values. The NCG Committee describedseeks to balance the values of continuity with regular refreshment, industry and external perspectives, as well as diversity in attributes and experiences.

The Directors’ diversity of attributes, backgrounds and skills is essential to the NCG’s assessment of the complementary aspects of the Board’s composition. The Board does not have and has not had to rely on a formal diversity policy to attract a board that is diverse by race, ethnicity, gender, age, and other attributes and skills. However, as previously noted, the Board, through its NCG Committee, strives to seek candidates for Board membership who will represent a diversity of attributes and experiences. If the current nominees to the Board are elected, as of our 2022 Annual Meeting, 50%, or three of our then six current directors will be people who are diverse by race, ethnicity, or gender. See the “Board Skills Summary” above for further information. Sources of Recommendation for Current Nominees. All of the current nominees for director included in this proxy statement is respectively independent under the standards listed above for purposes of membership on each of these committees; and each of the members of the Audit Committee also meets the additional independence requirements under Rule10A-3 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

Daniel J. Sullivan serves as the Chairman of the Board of Directors and is responsible for scheduling and setting the agenda for the executive sessions of the independent directors. Such executive sessions are expected to occur at regularly scheduled times during the fiscal year ending December 31, 2019, typically in conjunction with a regularly scheduled Board meeting, in addition to the separate meetings of the standing committees of the Board of Directors.

The Board of Directors has also adopted a statement of corporate governance principles that is available on the Company’s website.See “Corporate Governance and Website Information.”

Audit Committee

The Company has a separately-designated standing Audit Committee, which is composed of five directors: James R. Helvey III, Chairman, David H. Klein, Valerie Rahmani, Daniel J. Sullivan, and Owen J. Sullivan, and operates under a written charter adopted by the Board of Directors. The charter of the Audit Committee is available on our Company’s website.See “Corporate Governance and Website Information.” The Audit Committee met 6 times during 2018.

The primary purposes of the Audit Committee are to oversee on behalf of the Company’s Board of Directors: (1) the accounting and financial reporting processes of the Company and integrity of the Company’s financial statements, (2) the audits of the Company’s financial statements and appointment, compensation, qualifications, independence and performance of the Company’s independent registered public accounting firm, (3) the Company’s compliance with legal and regulatory requirements, (4) the Company’s internal audit function, and (5) the preparation of the Audit Committee report that SEC rules require to be included in the annual proxy statement. The Audit Committee’s job is one of oversight. Management is responsible for the Company’s

8

financial reporting process including its system of internal control, and for the preparation of the Company’s consolidated financial statements in accordance with U.S. generally accepted accounting principles. The Company’s independent registered public accounting firm is responsible for auditing those financial statements. It is the Audit Committee’s responsibility to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct audits or accounting reviews. Therefore, the Audit Committee has relied on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with U.S. generally accepted accounting principles, on its discussions with the independent registered public accounting firm and on the representations of the Company’s independent registered public accounting firm included in its report on the Company’s financial statements.

The Board of Directors has determined that the members of the Audit Committee are independent as described above under “Director Independence and Executive Sessions” and that each of them is able to read and understand fundamental financial statements. The Board of Directors has determined that James R. Helvey III is an “audit committee financial expert” as defined in Item 407 of RegulationS-K. Under the rules of the SEC, the determination that a person is an audit committee financial expert does not impose on such person any duties, obligations or liability any greater than the duties, obligations and liability imposed on any other member of the Audit Committee or the Board of Directors. Moreover, the designation of a person as an audit committee financial expert does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

Audit Committee Report

The Audit Committee has reviewed and discussed the audited financial statements with management; and has discussed with the Company’s independent auditors the matters required to be discussed pursuant to PCAOB Auditing Standard No. 61, as amended. In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accountant the independent registered public accountant’s independence.

Based on the review and discussions referred to above, the Audit Committeeformally recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form10-Kfor the last fiscal year for filing with the SEC.

Submittednomination by the Audit Committee

James R. Helvey III, Chairman

David H. Klein

Valerie Rahmani

Daniel J. Sullivan

Owen J. Sullivan

Nominating and Corporate Governance Committee and Director Nomination Process

The Nominating and Corporate Governance Committee is composed of David H. Klein, Chairman, James R. Helvey III, Valerie Rahmani, Daniel J. Sullivan, and Owen J. Sullivan. This Committee held 3 meetings during 2018.

This Nominating and Corporate Governance Committee has a charter that is available on our Company’s website. See “Corporate Governance and Website Information.” The primary purposes of the Committee are to

9

(a) identify and select the individuals qualified toincumbent independent directors who serve on the Company’s Board of Directors for election by shareholders at each annual meeting of shareholders and to fill vacancies on the Board of Directors, (b) implement the Board’s criteria for selecting new directors, (c) develop, recommend to the Board, and assess corporate governance policies for the Company, and (d) oversee the evaluation of the Board.NCG Committee.

The Board of Directors has determined that the members of the Nominating and Corporate Governance Committee are independent as described above under “Director Independence and Executive Sessions.”

Director Nominations Made by Shareholders. The Nominating and Corporate GovernanceNCG Committee will consider director nominations timely made by shareholders pursuant to the requirements of ourthe Company’s Restated By-laws, which are further discussed under “Procedure for Shareholders to Nominate Directors” and “Shareholder Proposals.”Proposals” herein. The Nominating and Corporate GovernanceNCG Committee has not formally adopted any specific elements of this policy, such as minimum specific qualifications or specific qualities or skills that must be possessed by qualified nominees, beyond the Nominating and Corporate GovernanceNCG Committee’s willingness to consider candidates proposed by shareholders. The Company did not receive any shareholder-nominated director candidates for consideration this year. Procedure for Shareholders to Nominate Directors. Any shareholder who intends to present a director nomination proposal for consideration at an annual meeting of shareholders mayshall use the procedures set forth in the Company’s Restated By-laws. For shareholder nominations of directors to be properly brought before an annual meeting by a shareholder pursuant to the Restated By-laws, the shareholder must have given timely notice thereof in writing to the Secretary of the Company. Subject to the rights of the holders of any class or series of stock having a preference over the Company’s common stock as to dividends or upon liquidation, nominations for the election of directors may be made by or at the direction of the Board of Directors or by any shareholder entitled to vote for the election of directors who complies

with the following procedures. Any shareholder entitled to vote for the election of directors at a meeting of shareholders may nominate persons for election as directors only if written notice of such shareholder’s intent to make such nomination is given, either by personal delivery or by United States mail, postage prepaid, to and received by the Secretary of the Company by the close of businessCorporation at the principal executive offices of the Company (i) with respect to an election to be held at a special meeting of shareholders for the election of directors, the close of businessby 5:30 pm, Eastern Time, on the 10th day following the date public announcement of the date of such meeting is first made and (ii) with respect to an election to be held at an annual meeting of shareholders, by 5:30 pm, Eastern Time, on a date not less than 90 and not earlier than 120 days prior to theone-year anniversary of the date of the preceding year’s annual meeting of shareholders; provided, however, that if the meeting is convened more than 30 days prior to or delayed by more than 60 days after theone-year anniversary of the date of the preceding year’s annual meeting, or if no annual meeting was held in the preceding year, notice by the shareholder of record to be timely must be so received notno earlier than the close of businessby 5:30 pm, Eastern Time, on the 120th day prior to the date of the annual meeting and notno later than the close of business5:30 pm, Eastern Time, on the later of (1) the 90th day before the date of such annual meeting or (2) if the first public announcement of the date of such annual meeting is less than 100 days prior to the date of such annual meeting, the 10th day following the day on which public announcement of the date of such meeting is first made. In no event shall an adjournment or postponement of an annual meeting of shareholders for which notice has been given commence a new time period (or extend any time period) for the giving of a notice by a shareholder. Each such notice shall set forth as to the shareholder giving the notice and the beneficial owner or owners, if any, or other persons on whose behalf the nomination is made or acting in concert therewith (each, a “party”): (1) the name and address of such party; (2) a representation that the shareholder giving the notice is, as of the date of such notice, a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (3) the class, series, and number of shares of the Company that are owned, directly or indirectly, beneficially and of record by each such party;party as of the date of such notice; (4) a description of, as of the date of such notice, any option, warrant, convertible security, stock appreciation right or similar right with an exercise or conversion privilege or providing for a settlement payment or mechanism based on the price of any class or series of shares of the Company or with a value derived in whole or in part from the value of any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise (a “Derivative Instrument”), including the class, series and number of shares of the Company subject to such Derivative Instrument, directly or indirectly owned 10

beneficially by each such party, and a description of, as of the date of such notice, any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company;Company, including the class, series and number of shares of the Company subject to such opportunity; (5) a description of, as of the date of such notice, any proxy, contract, arrangement, understanding or relationship pursuant to which any party, either directly or acting in concert with another person or persons, has a right to vote, directly or indirectly, any shares of any security of the Company; (6) any short interest or other borrowing arrangement in any security of the Company held by each such party (for purposes of this provision, a person shall be deemed to have a short interest in a security if such person directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has the opportunity to profit or share in any profit derived from any decrease in the value of the subject security),; (7) a description of, as of the date of such notice, any rights to dividends on the shares of the Company owned beneficially directly or indirectly by each such party that are separated or separable from the underlying shares of the Company,Company; (8) any proportionate interest in shares of the Company or Derivative Instruments held, directly or indirectly, by a general or limited partnership in which any party is a general partner or, directly or indirectly, beneficially owns an interest in a general partner;partner, including the number thereof; (9) a description of, as of the date of such notice, any performance-related fees (other than an asset-based fee) that each such party is directly or indirectly entitled to, based on any increase or decrease in the value of shares of the Company or Derivative Instruments, if any, as of the date of such notice, including without limitation any such interests held by members of each such party’s immediate family sharing the same household (which information set forth in this paragraph shall be supplemented by such shareholder or such beneficial owner or other person, as the case may be, not later than 10 days after the record date for the meeting to disclose such ownership as of the record date);household; (10) any other information relating to each such party that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, as applicable, the proposal and/or for the election of directors in a contested election pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (whether or not such party intends to deliver a proxy statement or conduct its own proxy solicitation); and (11) a statement as to whether or not each such party will deliver a proxy statement and form of proxy to holders of at least the percentage of voting power of all of the shares of common stock reasonably believed by such party to be sufficient to elect the persons proposed to be nominated by the shareholder. Each such notice shall also set forth as to each person whom the shareholder proposes to nominate for election or reelection as a director: (1) a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; (2) the name and address of each such nominee; (3) such other

information regarding each nominee proposed by such shareholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had each nominee been nominated, or intended to be nominated, by the Board of Directors; (4) a written representation and agreement of each nominee (in the form provided by the Secretary of the Company upon written request) that such nominee, would be in compliance, if elected as a director of the Company, would be in compliance and will comply with all corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of the Company; (5) the consent of each nominee to serve as a director of the Company if so elected and (if applicable) to being named in the Company’s proxy statement and form of proxy as a nominee; and (6) the written representation and agreement of each nominee that such nominee currently intends to serve as a director of the Company for the full term for which such person would be standing for election, if elected. A shareholder providing notice of a nomination for the election of a director shall further update and supplement such notice, if necessary, so that the information provided or required to be provided in such notice shall be true and correct as of the record date for the meeting and as of the date that is 10ten business days prior to the meeting or any adjournment or postponement thereof, and such update and supplement shall be delivered to, or mailed and received by, the Secretary at the principal executive offices of the Company not later than 55:30 pm, Eastern Time, on the date five business days after the record date for the meeting (in the case of the update and supplement required to be made as of the record date), and not later than 55:30 pm, Eastern Time, on the date five business days prior to the date for the meeting, if practicable (or, if not practicable, on the first practicable date prior to)to such meeting) any adjournment or postponement thereof (in the case of the update and supplement required to be made as of 10ten business days prior to the meeting or any adjournment or postponement thereof). A shareholder providing notice of a nomination for the election of a director shall also, no later than 5:30 pm, Eastern Time, on the date five business days after a request by or on behalf of the Board of Directors, provide to the Secretary by United States mail, postage prepaid, or personal delivery at the principal executive offices of the Company, such additional information requested by or on behalf of the Board of Directors to assess the qualifications of any person whom the shareholder proposes to nominate for election or reelection as a director. In addition, a shareholder must also comply with all applicable requirements of the Securities Exchange Act and the rules and regulations thereunder with respect to matters described above. HOW WE ARE ELECTED 11

Directors elected to Class II at the 2020 Annual Meeting and 2021 Annual Meeting are currently serving for a three-year and two-year term, respectively, expiring at the Annual Meeting of Shareholders in 2023, or until his or her successor has been elected and qualified or until his or her death, resignation or retirement. Directors elected to Class III at the 2021 Annual Meeting are currently serving for a three-year term expiring at the Annual Meeting of Shareholders in 2024, or until his or her successor has been elected and qualified or until his or her death, resignation or retirement.The shares represented by properly executed and timely returned proxies will be voted, in the absence of contrary instructions, in favor of the election of the following two Class I director nominees: David H. Klein and Valerie Rahmani. All nominees have consented to serve as directors, if elected. However, if at the time of the meeting any nominee is unable to stand for election, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be nominated by the Board. HOW WE ARE EVALUATED The charter of the NCG Committee provides that the Committee is charged with the responsibility of overseeing the evaluation of the Board Composition and Diversity.its Committees. Each year the Board and each of its Committees conduct an anonymous self-evaluation aimed at enhancing the Board and individual Director performance. Each Director is provided with one evaluation questionnaire for the full Board and for each standing Committee on which such Director serves. The NominatingBoard has engaged independent legal counsel to prepare, aggregate and provide a report summarizing the responses of each

Director. The report is then provided to the Chair of the Board and each of the Committees who then review the results in executive session. Policies and practices are updated as appropriate as a result of Director feedback. HOW WE ARE ORGANIZED The Board currently has six directors and the following committees: (i) Audit, (ii) Compensation, and (iii) NCG. Audit Committee The Company has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, which is currently composed of five directors: James R. Helvey III, Chair, David H. Klein, Valerie Rahmani, Raj Rajgopal, and Kathryn A. Stein, and operates under a written charter adopted by the Board of Directors. The charter of the Audit Committee is available on our website. See “Corporate Governance Committee’s current process for identifying and evaluating nominees for director consists of general periodic evaluationsWebsite Information.” The Audit Committee met four times during 2021. The primary purposes of the sizeAudit Committee are to oversee on behalf of the Company’s Board of Directors: (1) the accounting and compositionfinancial reporting processes of the Company and integrity of the Company’s financial statements; (2) the audits of the Company’s financial statements and appointment, compensation, qualifications, independence and performance of the Company’s independent registered public accounting firm; (3) the Company’s compliance with legal and regulatory requirements; (4) the Company’s internal audit function; and (5) the preparation of the Audit Committee report required by SEC rules to be included in the annual proxy statement. The Audit Committee’s job is one of oversight. Management is responsible for the Company’s financial reporting processes including its system of internal controls, and for the preparation of the Company’s consolidated financial statements in accordance with U.S. generally accepted accounting principles. The Company’s independent registered public accounting firm is responsible for auditing those financial statements. It is the Audit Committee’s responsibility to monitor and review these processes. It is not the Audit Committee’s duty or responsibility to conduct audits or accounting reviews. Therefore, the Audit Committee has relied on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with U.S. generally accepted accounting principles, on its discussions with the independent registered public accounting firm, and on the representations of the Company’s independent registered public accounting firm included in its report on the Company’s financial statements. The Board of Directors has determined that the members of the Audit Committee are independent as described herein under “Director Independence and Executive Sessions” and that each of them is able to read and understand fundamental financial statements. The Board of Directors has determined that James R. Helvey III is an “audit committee financial expert” as defined in Item 407 of Regulation S-K. Under the rules of the SEC, the determination that a person is an audit committee financial expert does not impose on such person any duties, obligations, or liability any greater than the duties, obligations and liability imposed on any other member of the Audit Committee or the Board of Directors. Moreover, the designation of a person as an audit committee financial expert does not affect the duties, obligations, or liability of any other member of the Audit Committee or Board of Directors. Audit Committee Report The Audit Committee has reviewed and discussed the audited financial statements with management and has discussed with the Company’s independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accountant’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm such firm’s independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for filing with the SEC. Submitted by the Audit Committee James R. Helvey III, Chair David H. Klein Valerie Rahmani Raj Rajgopal Kathryn A. Stein Compensation Committee The Compensation Committee of the Board of Directors with(“Compensation Committee”) currently consists of Valerie Rahmani, Chair, James R. Helvey III, David H. Klein, Raj Rajgopal, and Kathryn A. Stein. During 2021, the Compensation Committee held a goaltotal of maintaining continuitysix meetings. The Board of appropriate industry expertise and knowledgeDirectors has determined that the members of the Company. Compensation Committee are independent as described herein under “Director Independence and Executive Sessions.” The NominatingCompensation Committee has a charter that is available on our Company’s website as described herein under “Corporate Governance and CorporateWebsite Information.” The primary purposes of the Compensation Committee are to: | (1) | review and approve corporate goals and objectives relevant to the Company’s compensation philosophy; |

| (2) | evaluate the CEO’s performance and determine the CEO’s compensation in light of those goals and objectives; |

| (3) | review and approve executive officer compensation, incentive compensation plans and equity-based plans; and |

| (4) | produce an annual report on executive compensation and approve the Compensation Discussion and Analysis for inclusion in the Company’s annual proxy statement or annual report on Form 10-K. |

For further discussion of the process and procedures for consideration and determination of executive and director compensation and discussion of the Compensation Committee’s use of an independent consultant to assist in reviewing and determining executive and director compensation, see “How Executive Compensation is Determined.” The Committee may delegate to one or more designated officers the authority to make grants of options and restricted stock to eligible individuals other than directors and officers, provided the Committee shall have fixed the exercise price or a formula for determining the exercise price for each grant, approved the vesting schedule, authorized any alternative provisions as are necessary or desirable to facilitate legal compliance or to ensure the effectiveness or tax-qualified status of the award under the laws of countries outside the U.S. when grants are made to non-U.S. employees, approved the form of documentation evidencing each grant, and determined the number of shares or the basis for determining such number of shares by position, compensation level, or category of personnel. NCG Committee and Director Nomination Process The NCG Committee is currently composed of David H. Klein, Chair, James R. Helvey III, Valerie Rahmani, Raj Rajgopal, and Kathryn A. Stein. This Committee held five meetings during 2021. This NCG Committee has a charter that is available on our Company’s website as described herein under “Corporate Governance and Website Information.” The primary purposes of the NCG Committee strivesare to: (1) identify and select the individuals qualified to composeserve on the Company’s Board of Directors for election by shareholders at each annual meeting of shareholders and to fill vacancies on the Board of Directors with individuals possessing a variety of complementary skills.Directors; With respect(2) implement the Board’s criteria for selecting new directors;

(3) develop, recommend to the nomineesBoard, and assess corporate governance policies for electionthe Company; and

(4) oversee the evaluation of the Board. The Board of Directors has determined that the members of the NCG Committee are independent as described herein under “Director Independence and Executive Sessions.” HOW WE GOVERN AND ARE GOVERNED Meeting Attendance During 2021, the Board held a total of eight meetings. Each director who was a member of the Board in 2021 attended at this meetingleast 75% of the aggregate number of Board and with respectcommittee meetings on which the director served. The Company encourages its Directors to the otherattend its Annual Meeting of Shareholders but has not adopted a formal policy requiring attendance. All Directors who were members of the Board in 2021 at the Nominatingtime of the 2021 Annual Meeting of Shareholders were in attendance, which was held virtually. Director Independence and Corporate Governance Committee and theExecutive Sessions The Board of Directors as a whole focused primarily on the experience, qualifications, attributes and skills discussed inaffirmatively determined that each of the director’s biographies set forth above. In each case, the NominatingCompany’s five current non-management directors (two of whom are also nominees for election), James R. Helvey III, David H. Klein, Valerie Rahmani, Raj Rajgopal, and Kathryn A. Stein, are independent directors in accordance with our Corporate Governance CommitteePolicies, a copy of which is available on our website (see “Corporate Governance and Website Information”), the rules of the SEC and the standards of the NASDAQ Stock Market (“NASDAQ”). As a result of these five directors being independent, a majority of our Company’s Board of Directors considered importantis currently independent as so defined. The Board of Directors has determined that there are no relationships between the achievements of the individual in the successful career described. With regard to Mr. Gydé, the Nominating and Corporate Governance CommitteeCompany and the directors classified as independent other than service on our Company’s Board believeof Directors. The Board of Directors also previously determined that it is important that they have immediate access to his direct involvement in the management of the Company as the Chief Executive Officer. With regard to Mr. Helvey, the Nominating and Corporate Governance Committee andOwen J. Sullivan, who retired from the Board particularly noted his extensive financial experienceeffective July 1, 2021, and prior audit committee experience. With regard to Mr. Klein, the Nominating and Corporate Governance Committee and the Board particularly noted his extensive experience managing health plan entities and his knowledge of the healthcare industry, an important market for the Company’s services. With regard to Ms. Rahmani, the Nominating and Corporate Governance Committee and the Board particularly noted her experience in cyber-security and her extensive management experience within the IT Services industry. With regard to Mr. Daniel J. Sullivan, the Nominating and Corporate Governance Committee andwho retired from the Board particularly noted the broad perspective resulting from his diverse experience in managing and servingeffective September 16, 2021, were “independent directors” as an officer for a large, public company. With regard to Mr. Owen J. Sullivan, the Nominating and Corporate Governance Committee and the Board particularly noted his extensive experience in the staffing solutions and professional resourcing industry, including his roles at ManpowerGroup. Although diversity may be a consideration in the Nominating and Corporate Governance Committee’s process, the Nominating and Corporate Governance Committee and the Board of Directors do not have a formal policy with regard to the consideration of diversity in identifying director nominees. Since neither the Board nor the Nominating and Corporate Governance Committee has received any shareholder nominations in the past, the Nominating and Corporate Governance Committee has not considered whether there would be any differences in the manner in which the Committee evaluates nominees for director based on whether the nominee is recommended by a shareholder.

Source of Recommendation for Current Nominees. The nominees for director included in this proxy statement have been formally recommendeddefined by the incumbent independent directors who serve onsame standards noted above.

The foregoing independence determination also included the Nominating and Corporate Governance Committee. Past Nominations from More Than 5% Shareholders.Under the SEC rules (and assuming consent to disclosure is given by the proponents and nominee), the Company must disclose any nominations for director made by any person or group beneficially owning more than 5% of the Company’s outstanding common stock received by the Company by the date that was 120 calendar days before the anniversary of the date on which its proxy statement was sent to its shareholders in connection with the previous year’s annual meeting. The Company did not receive any such nominations.

Shareholder Communications to the Board of Directors

Any record or beneficial owner of the Company’s common stock who has concerns about accounting, internal accounting controls, auditing matters or any other matters relating to the Company and wishes to communicate with the Board of Directors on such matters may contact the Audit Committee directly. The Audit Committee has undertaken on behalfconclusions of the Board of Directors to be the recipientthat:

each member of communications from shareholders relating to the Company. If particular communications are directed to the full Board, independent directors as a group, or individual directors, the Audit Committee, will routeCompensation Committee, and NCG Committee described in this proxy statement is independent under the standards listed above for purposes of membership on each of these communications tocommittees; and each member of the 12 Audit Committee also meets the additional independence requirements under Rule 10A-3 of the Exchange Act

appropriate directors or committees so longJames R. Helvey III serves as the intended recipients are clearly stated. Alternatively, any interested parties may communicate with the ChairmanChair of the Board of Directors by writingand is responsible for scheduling and setting the agenda for the executive sessions of the independent directors. Such executive sessions are expected to Daniel J. Sullivan, c/o Computer Task Group, Incorporated, 800 Delaware Avenue, Buffalo, New York 14209.

Communications intended to be anonymous may be made by callingoccur at regularly scheduled times during the Company’s Ethics and Compliance (Whistleblower) Hotline Service at844-627-6885 and identifying ones self as an interested party intending to communicatefiscal year ending December 31, 2022, typically in conjunction with the Audit Committee (this third party service undertakes to forward such communicationsa regularly scheduled Board meeting, in addition to the Audit Committee if so requested, assuming the intended recipient is clearly identified). You may also send communications intended to be anonymous by mail, without indicating your name or address, to Computer Task Group, Incorporated, 800 Delaware Avenue, Buffalo, New York 14209, Attention: Chairmanseparate meetings of the Audit Committee. Communications not intended to be made anonymously may also be made by callingstanding committees of the hotline number or by mail to that address.

Shareholder proposals intended to be presented at a meetingBoard of shareholders by inclusion in the Company’s proxy statement under SEC Rule14a-8 or intended to be brought before a shareholders’ meeting in compliance with the Company’sBy-laws are subject to specific notice and other requirements referred to under “Shareholder Proposals” and in applicable SEC rules and the Company’sBy-laws. The communications process for shareholders described above does not modify or eliminate any requirements for shareholder proposals intended to be presented at a meeting of shareholders. If you wish to make a proposal to be presented at a meeting of shareholders, you may not communicate such proposals anonymously and may not use the hotline number or Audit Committee communication process described above in lieu of following the notice and other requirements that apply to shareholder proposals intended to be presented at a meeting of shareholders.Directors.

Corporate Governance and Website Information The Company follows certain corporate governance requirements that it believes are in compliance with the corporate governance requirements of the NASDAQ listing standards and SEC regulations. The principal elements of these governance requirements as implemented by our Company are: affirmative determination by the Board of Directors that a majority of the directors are independent; regularly scheduled executive sessions of independent directors; Audit Committee, Nominating and Corporate GovernanceCompensation Committee, and CompensationNCG Committee comprised of independent directors and having the purposes and charters described above under the separate committee headings; corporate governance principles of our Board of Directors; specific authorities and procedures outlined in the charters of the Audit Committee, Nominating and Corporate GovernanceNCG Committee and Compensation Committee; and a Code of Business Conduct applicable to directors, officers, and employees of our Company. This code also contains asub-section that constitutes a code of ethics (the “Code of Ethics”) specifically applicable to the Chief Executive Officer, Chief Financial Officer and other members of our Company’s finance department

| | based on their special role in promoting fair and timely public reporting of financial and business information about our Company. |

The charters of the Audit Committee, Compensation Committee, and Nominating and GovernanceNCG Committee, the corporate governance principlesCorporate Governance Policies of the Board of Directors, and the Code of Business Conduct are available without charge on the Company’s website at www.ctg.com, by clicking on “Investors,” and then “Corporate Governance.” We will also send these physical documents without charge and in print to any shareholder who requests them. The Company intends to disclose any amendments to or waivers of the Code of Business Conduct on its website. 13

Board Leadership and Role in Risk Oversight The Company’s Board has elected to separate the ChairmanChair and the CEO roles and has appointed Daniel J. SullivanJames R. Helvey III to serve as the Company’s Chairmanindependent Chair of the Board. The Company believes that splitting such roles promotes independent oversight of management and facilitates a balance of power more aligned with shareholder interests. The Board views enterprise risk management (“ERM”) as an integral part of the Company’s strategic planning process and, as such, has charged the Audit Committee with the responsibility of overseeing the ERM process. To facilitate coordination of ERM at the operational level, the Audit Committee appointed the Company’s CFO as the Company’s Chief Risk Officer (“CRO”). In this capacity as CRO, the CFO works with the CEO and executive officers of the Company to provide periodic ERM reports to the Audit Committee and strives to generate careful and thoughtful attention on the Company’s ERM process, the nature of material risks to the Company and the adequacy of the Company’s policies and procedures designed to mitigate these risks. Among the matters that are considered in the Company’s ERM process is the extent to which the Company’s policies and practices for incentivizing and compensating employees, includingnon-executive officers, may create risks that are reasonably likely to have a material adverse effect on the Company. In this manner, the Board believes it appropriately encourages management to promote a corporate culture that appreciates risk management and incorporates it into the overall strategic planning process of the Company. Social Responsibility Our social responsibility principles inform the way we work. CTG is committed to the highest standards in our labor practices, the health and safety of our employees, and business ethics. CTG has business operations in the Americas, Western Europe and India, all regions with strict labor laws regarding human rights. We have internal policies intended to ensure our compliance with these laws, and we will not knowingly conduct business with anyone who violates these laws or basic human rights. We are committed to adhering to the Fair Labor Standards Act (“FLSA”), local labor laws, and prevailing wage rates. CTG prohibits any form of workplace or sexual harassment, and all employees are required to work in a manner that prevents harassment in the workplace. This policy is one component of CTG’s commitment to a discrimination-free work environment. None of CTG’s leased office spaces are subject to industrial hazards and all adhere to the Occupational Safety and Health Administration (“OSHA”) office standards. We will not knowingly transact business with, or place our team members at, companies that do not enforce appropriate workplace safety and health standards. Our Code of Business Conduct serves as our baseline for business ethics, and all employees are required to adhere to these guidelines. We are committed to providing clients with high-quality services that conform to mutually agreed-upon requirements and maintain certifications that support our Quality Policy, including 9001:2015 certification for our European operations. CTG Luxembourg PSF S.A. holds the “Entreprise Socialement Responsable” (Socially Responsible Enterprise) label that is awarded by the INDR Luxembourg (Institut National pour le Développement Durable et la Responsabilité Sociale des Entreprises), an organization that aims to promote responsible business practices in Luxembourg. Our whistleblower hotline ensures that there is a confidential way to report any concerns with CTG business practices. Specific to CTG Luxembourg, PSF S.A., we have complaint handling (traitement des réclamations) processes for clients, in accordance with CSSF’s Regulation 16-07 and Circular 17/671.

Environmental Responsibility CTG maintains a relatively small carbon/environmental footprint. As a professional services provider, much of our focus is on the individual behavior of our team members and the decisions we make in managing our office spaces. Our environmental strategy has three areas of focus: Personal Initiative Many of our improvements come from our employee's environmentally conscious efforts. CTG supports these efforts by: Maintaining policies and initiatives to reduce our carbon/environmental footprint and tracking results Providing flexible and remote-working opportunities to reduce emissions Supporting environment-focused programs, such as Earth Day Raising awareness of environmentally sound practices through policy manuals, in-house publications, and websites Corporate Contracts and Purchasing CTG is committed to doing business with companies that share our environmental concern. Examples include purchasing environmentally-friendly products and prioritizing property management companies and office spaces that utilize environmentally friendly materials, policies, and services. Corporate Stewardship We are conscious of our impact on the communities our teams call home. Over the years, we have made significant improvements that support reducing the carbon/environmental footprint of our North American corporate headquarters, located in Buffalo, New York. In all locations, we are committed to ensuring that none of our outdated computer systems and electronics end up in landfills and that our office waste be disposed of through local energy-from-waste programs. COVID-19 Response The health, well-being and safety of our employees, clients and communities is our top priority. COVID-19 became a potentially significant issue during the first quarter of 2020 as we followed global developments and observed the impacts of COVID-19 in the Americas, Western Europe, and India, regions where we operate. Our senior management team initiated regular COVID-19 planning sessions to address the critical safety, operational and business risks associated with the global COVID-19 pandemic. With our continued commitment to monitor, assess and implement guidance and best practices for the Company as recommended by the World Health Organization (“WHO”) and Centers for Disease Control and Prevention (“CDC”), we have been able to maintain the continuity of the essential services that we provide to our clients, while also managing the impact of the spread of the virus within our business, as well as promoting the health, well-being and safety of our employees, clients and communities. Anti-Hedging Policy The Company’s Insider Trading Policy, which is available on the Company’s website (see “Corporate Governance and Website Information” herein), prohibits certain speculative transactions by directors, officers, employees and consultants of the Company and its subsidiaries as well as their family members who reside with them, anyone else who lives in their household and any family members who do not live in their household but whose transactions in Company securities are directed by them or subject to their influence or control (all such persons, “Covered Persons”). Covered Persons are not permitted to engage in hedging or monetization transactions, such as zero-cost collars and forward sale contracts, which allow stockholders to lock in the value of their stock holdings in exchange for all or part of the potential for upside appreciation in the stock. In addition, Covered Persons may not engage in short sales of the Company’s securities (sales of securities that are not then owned), including sales against the box (sales of owned shares with delayed delivery). Audit Committee’s Review of Related Person Transactions In accordance with the Audit Committeeits charter, the Audit Committee reviews related person transactions. It isThe Audit Committee charter provides that the Company’s written policy that itCompany will not enter into transactions that are considered related person transactions that are required to be disclosed under Item 404 of the SEC’s RegulationS-K unless the Audit Committee or another independent body of the Board of Directors first reviews and approves or ratifies

the transactions. Under the SEC’s rules, a “related person” includes any of our directors or executive officers, certain of our shareholders and any of their respective immediate family members. Covered transactions under the SEC’s rules include those in which the Company is a participant, a “related person” that will have a direct or indirect material interest, and the amount involved exceeds $120,000. HOW YOU CAN COMMUNICATE WITH US Our Board of Directors values input from a wide variety of sources to inform its deliberations and decision- making. The Board recognizes that shareholders are an excellent source of insights and have a financial stake in the wisdom of those insights. The Board therefore enables shareholder communication via a variety of channels. Shareholders may participate in and ask questions during our annual shareholder meetings. We describe in this proxy statement how shareholders of record on the meeting record date can do so at the Annual Meeting. Shareholders may also interact regularly with management and the Board, primarily around quarterly earnings releases. Shareholder interactions with management are regularly communicated back to the Board. 14

COMPENSATION DISCUSSION AND ANALYSIS

CompensationIn addition, any record or beneficial owner of the Company’s common stock who has concerns about accounting, internal accounting controls, auditing matters or any other matters relating to the Company and wishes to communicate with the Board of Directors on such matters may contact the Audit Committee Composition and Primary Purposes

directly. The CompensationAudit Committee has undertaken, on behalf of the Board of Directors, consiststo be the recipient of Valerie Rahmani,communications from shareholders relating to the Company. If particular communications are directed to the full Board, independent directors as a group, a Board committee or individual directors, the Audit Committee will route these communications to the appropriate noted parties so long as the intended recipients are clearly stated in the communications received. Communications intended to be anonymous may be made by calling the Company’s Whistleblower Hotline Service at +1 844 627 6885 and identifying oneself as an interested party intending to communicate with the Audit Committee (This third-party service undertakes to forward such communications to the Audit Committee if so requested, assuming the intended recipient is clearly identified). You may also send communications intended to be anonymous by mail, without indicating your name or address, to Computer Task Group, Incorporated, 300 Corporate Parkway, Suite 214N, Amherst, New York 14226, Attention: Chair of the Audit Committee. Communications not intended to be made anonymously may be made by telephone to the hotline number or by mail to the same address. Alternatively, any interested parties may communicate with the Chair of the Board of Directors by writing to: Computer Task Group, Incorporated, Attn: Chair of the Board of Directors, 300 Corporate Parkway, Suite 214N, Amherst, New York 14226. Shareholder proposals intended to be presented at a meeting of shareholders by inclusion in the Company’s proxy statement under Exchange Act Rule 14a-8 or intended to be brought before a shareholders meeting in compliance with the Company’s Restated By-laws are subject to specific notice and other requirements referred to herein under “Shareholder Proposals” and in applicable SEC rules and the Company’s Restated By-laws. The communications process for shareholders described above does not modify or eliminate any requirements for shareholder proposals intended to be presented at a meeting of shareholders. If you wish to make a proposal to be presented at a meeting of shareholders, you may not communicate such proposals anonymously and may not use the hotline number or Audit Committee communication process described above instead of following the notice and other requirements that apply to shareholder proposals intended to be presented at a meeting of shareholders.

HOW WE ARE PAID 2021 DIRECTOR COMPENSATION Name of Director | | Fees Earned or Paid in Cash (1) ($) | | | Stock Awards (1) ($) | | | Total ($) | | James R. Helvey III | | $ | 104,110 | | | $ | 90,000 | | | $ | 194,110 | | David H. Klein | | $ | 70,000 | | | $ | 90,000 | | | $ | 160,000 | | Valerie Rahmani | | $ | 70,000 | | | $ | 90,000 | | | $ | 160,000 | | Raj Rajgopal | | $ | 60,000 | | | $ | 90,000 | | | $ | 150,000 | | Kathryn A. Stein | | $ | 30,000 | | | $ | 45,000 | | | $ | 75,000 | | Daniel J. Sullivan (2) | | $ | 120,000 | | | $ | 67,500 | | | $ | 187,500 | | Owen J. Sullivan (3) | | $ | 30,000 | | | $ | 45,000 | | | $ | 75,000 | |

(1) | At the election of the directors, the director’s base compensation fees for 2021 were paid 40% in cash and 60% in the form of deferred stock units granted under the 2020 Equity Award Plan and deposited into the Non-Employee Director Deferred Compensation Plan. Awards were granted using the closing stock price on the date of grant, vested ratably throughout the year and were fully vested at December 31, 2021. |

(2) | Effective September 16, 2021, Daniel J. Sullivan retired from the Board. |

(3) | Effective July 1, 2021, Owen J. Sullivan retired from the Board. |